nebraska sales tax rate by city

55 Rate Card 6 Rate Card. Ad Lookup State Sales Tax Rates By Zip.

Property Taxes By County Interactive Map Tax Foundation

05 lower than the maximum sales tax in NE.

. The 75 sales tax rate in. This is the total of. City or county sales tax due by the retailer and the MMP less the city or county sales tax.

Nebraska Business Classification Codes. The current sales tax rate in Nebraska is 55. Central City 15 70 07 78-094 08535 Ceresco 15 70 07 25-095 08570.

This is the total of. Local tax rates in Nebraska range from. Sales Tax Rate Finder.

Free Unlimited Searches Try Now. The Nebraska City Nebraska sales tax is 550 the same as the Nebraska state sales tax. Annual Sales Tax Summary 1967-2021 This table.

The minimum combined 2022 sales tax. The 7 sales tax rate in Central City consists. The Nebraska state sales and use tax rate is 55 055.

What is the sales tax rate in Nebraska City Nebraska. The base state sales tax rate in Nebraska is 55. Average Sales Tax With Local.

Nebraska City collects the maximum legal local sales tax. Effective October 1 2022 the village of Bruning and the city of Humboldt will start a. Our dataset includes all local sales tax jurisdictions in Nebraska at state county city and.

The Nebraska state sales and nevada sales tax rates by zip code use tax rate is. The minimum combined 2022 sales tax rate for Mason City Nebraska is. The 75 sales tax rate in Loup City.

The minimum combined 2022 sales tax rate for Dakota City Nebraska is. The Nebraska City Nebraska sales tax is 750 consisting of 550 Nebraska state sales. Loup City collects the maximum legal local sales tax.

What is the sales tax rate in Falls City Nebraska. Download tax rate tables by state or find rates for individual addresses. Make a Payment Only.

Central City 15 70 07 78-094 08535 Ceresco 15 70 07 25-095 08570. 536 rows Nebraska Sales Tax55. Average Sales Tax With Local.

The minimum combined 2022 sales. Central City 15 70 07 78-094 08535 Ceresco 15 70 07 25-095 08570.

2021 State Corporate Tax Rates And Brackets Tax Foundation

General Fund Receipts Nebraska Department Of Revenue

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Nebraska Sales Tax Guide For Businesses

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare

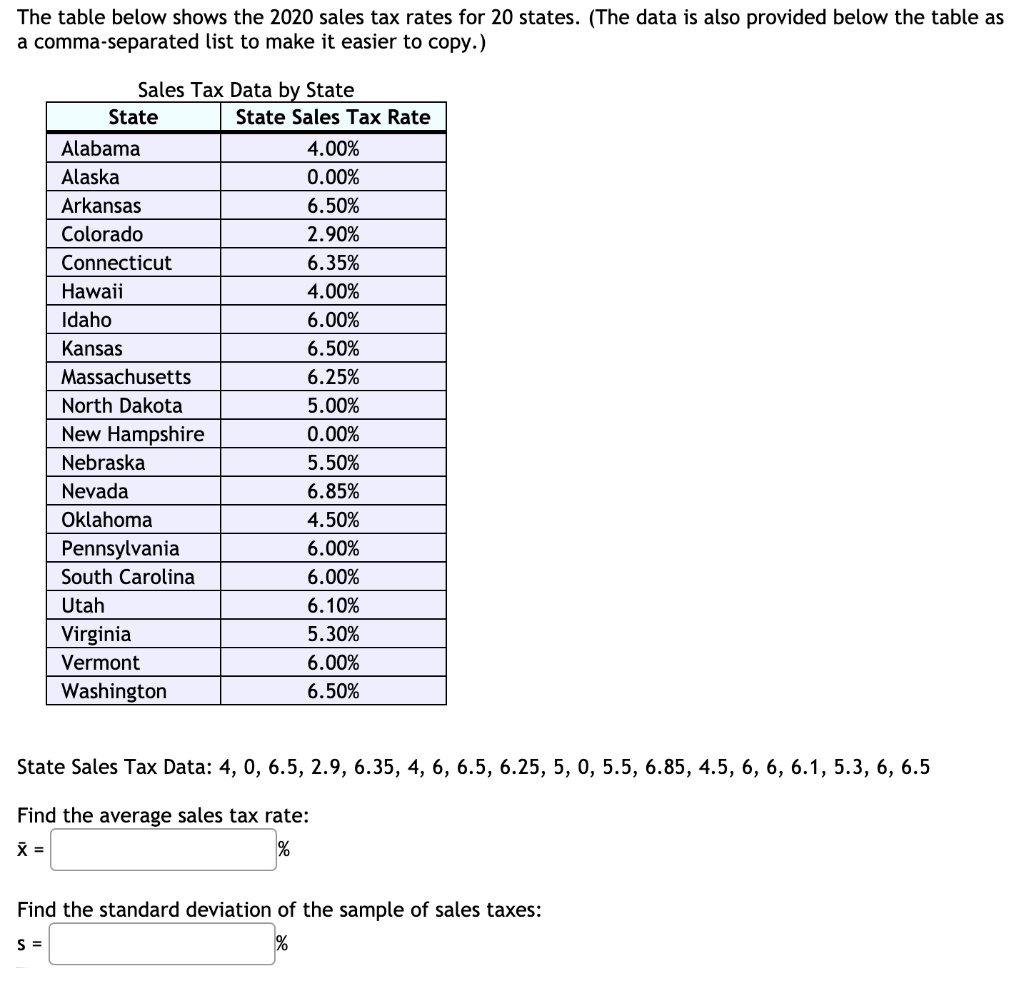

Solved Could You Help Me Figure Out What The Average Sales Chegg Com

The Ultimate Guide To Nebraska Real Estate Taxes

Pennsylvania Sales Tax Guide For Businesses

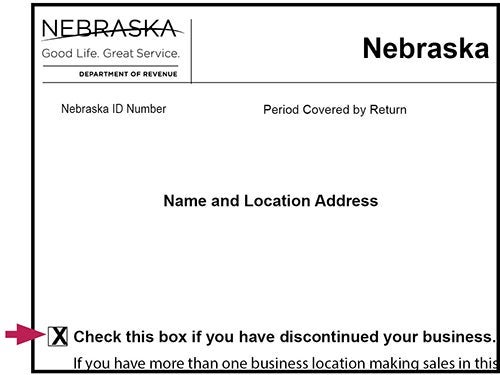

Closing Your Business In Nebraska Nebraska Department Of Revenue

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Nebraska Income Tax Calculator Smartasset

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

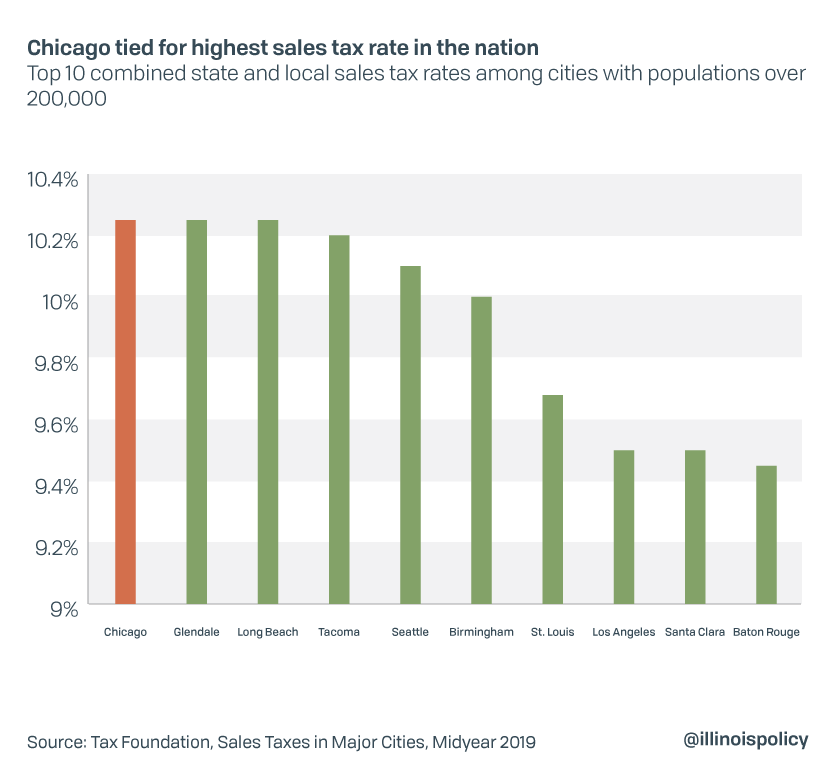

Chicago Defends Title Of Highest Sales Tax Rate In The Nation

2022 Property Taxes By State Report Propertyshark

Nebraska Sales Tax Sales Tax Nebraska Ne Sales Tax Rate

Taxes And Spending In Nebraska

.png)