espp tax calculator uk

The look back price will only take into account the price at. An employee stock purchase plan ESPP is a company-run program in which participating employees can purchase company stock at a discounted price.

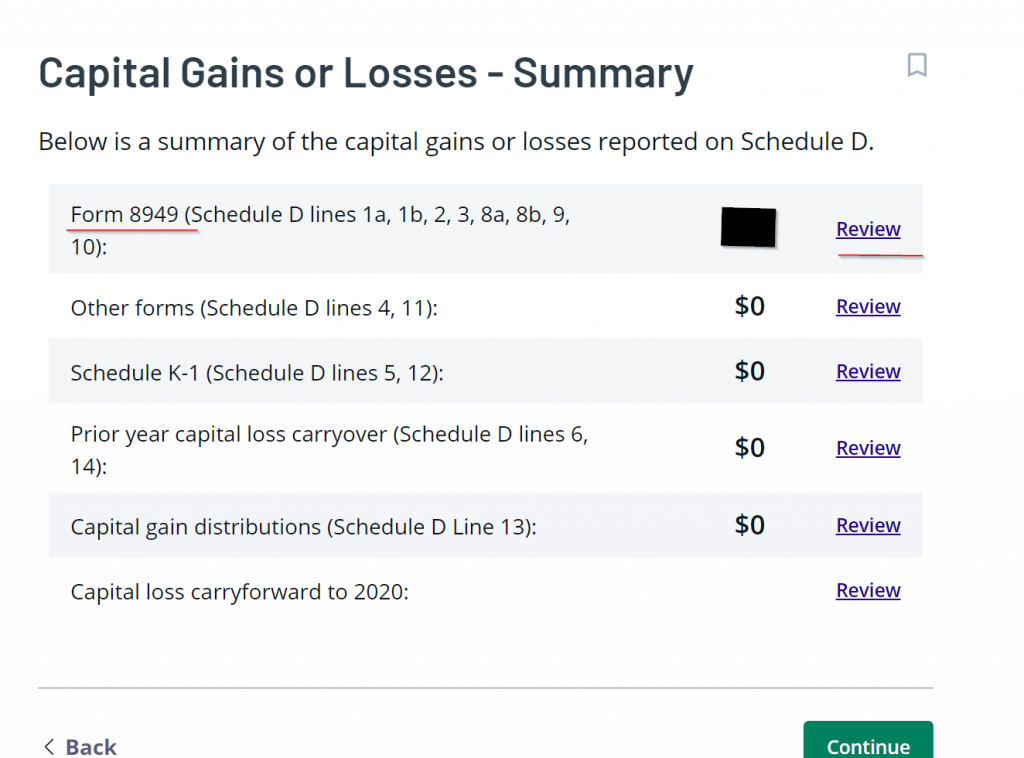

You can deduct certain costs of buying or selling your shares from your gain.

. Price shares are finally sold. You always want the. Make your plan more attractive.

ESPP is common among US companies often with a framework similar to your outline. Employee ESPP programs. Espp Tax Calculator Spreadsheet.

The gain calculated using the actual purchase price and. Employee Stock Purchase Plan. The ESPP gives you the chance to own a.

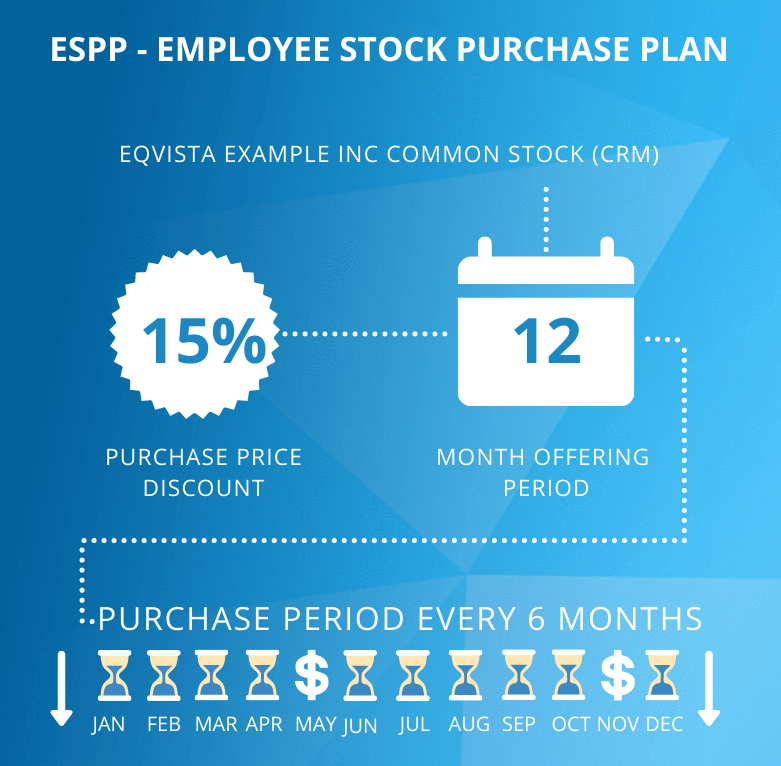

Your work makes Intuit successful and the Employee Stock Purchase Plan ESPP is another way to be rewarded. ESPP Discount of 15. An ESPP allows employees to purchase shares of company stock through automatic deductions from their paychecks.

Tax advantages on employee share schemes including Share Incentive Plans Save As You Earn Company Share Option Plans and Enterprise Management Incentives. The enrollment date 1 Jan or B. In the US some ESPPs allow sales of shares to be considered qualifying subject to capital gains rather.

The Employee Stock Purchase Plan ESPP provided by many publicly traded companies is a great benefit but the benefit calculation is not simple if you are not familiar with. The discount offered based on the offering date price or. Home Calculator Spreadsheet Espp Tax Calculator.

You can offset that 15 against the UK tax liability due in respect of that income that arose - fill in SA106 Foreign on your tax return and claim Foreign Tax Credit Relief. The ESPP lookback feature allows you to purchase the share price of either A. The enrollment date 1 Jan or B.

Navigating the performance and tax implications of your employee stock purchase plan can be overwhelming. Published at Monday June 14th 2021 051621 AM. The ESPP tax rules require you to pay ordinary income tax on the lesser of.

The price could have risen to 200 or dropped to 100 it wont matter. It is an approved UK plan but managed by the US company. The majority of publicly.

Again you are in the 24 tax bracket and 15. Fees for example stockbrokers fees. Contributions are accumulated during a specified period offering.

Stamp Duty Reserve Tax SDRT when you. Home Calculator Spreadsheet Espp Tax Calculator Spreadsheet. In most cases the discount you received will be reported as ordinary income in Box 1 of.

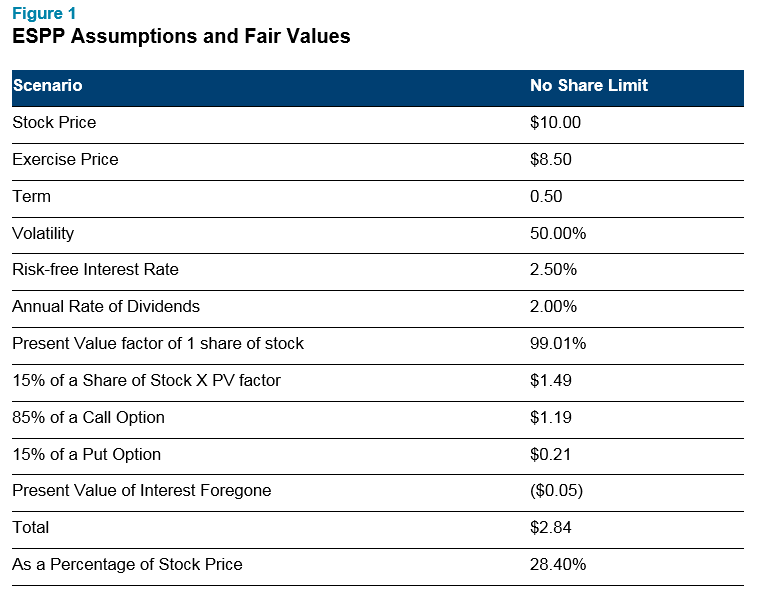

ESPP Basis current About. This calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and the first date of the subscription. The trading account is also in the US.

For the ESPP those dates wont matter. Employee Stock Purchase Plan ESPP Calculator. 1700 2000 300 Number of shares.

I plan to contribute a of my salary into the plan over the next 12 months. The gain calculated using the actual purchase price and.

What Are Employee Stock Purchase Plans Espp Ramseysolutions Com

Is An Employee Stock Purchase Plan Espp Better Than A Retirement Account Early Retirement Now

Espp Or Employee Stock Purchase Plan Eqvista

Sold My Espp Shares Nice Profit More Tax Owed

Adjust Cost Basis For Espp Rsu Tax Return Wealth Capitalist

Should I Participate In My Company S Employee Stock Purchase Plan Espp

Is An Employee Stock Purchase Plan Espp Better Than A Retirement Account Early Retirement Now

Determining The Fair Value Of Your Espp Human Capital Solutions Insights

2018 Employee Stock Purchase Plans Survey Deloitte Us

Video Included For How Long Must I Hold Shares Purchased Under A Section 423 Espp To Receive Favorable Tax Treatment Mystockoptions Com

Restricted Stock Units Jane Financial

Rsus A Tech Employee S Guide To Restricted Stock Units

Espp Gain And Tax Calculator Equity Ftw

The Minimal Investor Espp Guide And Calculator Minafi

Employee Stock Purchase Plan Espp The 5 Things You Need To Know